W-2 vs. W-4: A Comparison of Tax Forms and How to File Them

W-2 and W-4 forms are tax-related documents that every employer must use to report employee earnings to the Internal Revenue Service (IRS). These forms list the salary paid to employees and the taxes withheld from paychecks. They are mandatory for all full-time and part-time employees.

In this article, we will break down the details of a W-2 vs. a W-4 and explain how to file these two tax forms correctly.

What Is a W-2 Form?

The W-2 is short for an employee’s Wage and Tax Statement. Employers need to fill out this form for all employees that earned at least $600 in the given tax year. They need to report it to the Social Security Administration (SSA) either by mail or online by Jan. 31. For example, a W-2 for the tax year of 2022 should be filed by Jan. 31, 2023.

The W-2 form lists an employee’s gross earnings, tips, tax withholdings, compensations, such as Social Security and Medicare taxes, and other contributions to retirement accounts, such as child support. The employer should also send a copy of the W-2 to their local or state tax department and each employee to help them fill out their tax returns.

What’s In a W-2?

To complete the W-2, the employer needs the following information:

- The employer’s name, address, and ZIP code

- Employee Identification Number (EIN)

- Employee’s Social Security number (SSN)

- The employee’s wages, contributions, and tax withholdings

Many software programs like Aatrix and TaxRight can help you prepare and file the W-2 form.

Who Fills Out a W-2 Form?

It is the employer’s responsibility to fill out a W-2 form for each employee using payroll data for a given year. The employer should fill it out and submit it to the IRS by Jan. 31 of the following year.

How to Get a W-2 Online?

You can obtain a blank W-2 Form online from the IRS’s official website.

What Is a W-4 Form?

Conversely, a W-4 form is the Employee’s Withholding Certificate. This form lets employers know how much tax to withhold from an individual employee’s paycheck. Employees must fill out a W-4 at the time of onboarding and any time their withholding or filing status changes, such as when they get married or want to file jointly. Inaccurate W-4s or failing to file taxes can result in tax fraud.

What’s In a W-4?

Through the W-4 form, the employee has to inform their workplace of the following:

- Income level

- Marital status: single, married filing jointly, married filing separately, or head of household

- Income from a second job or a working spouse (if applicable)

- Number of people depending on them financially, such as children (if applicable)

- Child/dependent care costs (if applicable)

How to Fill Out a W-4?

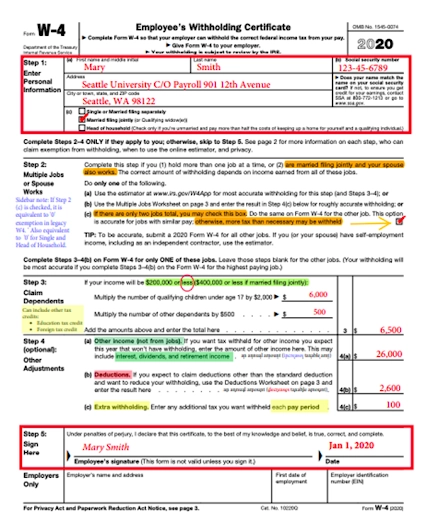

The W-4 form has five steps that need to be completed by the employee. Those include the following:

- Step 1 – Personal Information: Here, the employee should provide their full name, address, SSN, and marital/filing status.

Step 2 – Multiple or spousal incomes: Indicate if the employee has multiple jobs or is filing jointly with a spouse who also works. This step is required if the employee has a second source of income or is married and filing jointly. - Step 3 – Claim dependents: Include the number of dependents, such as children, that the employee claims on their tax return. In the first box, the employee should indicate the number of qualified children under 17 multiplied by $2,000.

- The second box includes the number of other dependents, such as stepchildren, siblings, and parents, multiplied by $500. Add these numbers and indicate the total in the final box. Leave this section blank if no dependents are claimed.

- Step 4 – Adjustments: If the employee wants to adjust their withholdings, they can mention it here. For instance, if the employee has passive income from investments, the employee may want to increase their withholdings. However, this step is optional.

- Step 5 – Employee Signature: Required.

Example of W-4 Form Filled Out

Here’s an example of a correctly completed W-4 form:

Employees can either print and fill out the form by hand or complete it electronically and send it to the employer.

How To Get a W-4 Online?

Your employer may share the W-4 form with you to complete, but it is also available for download online from the IRS’s official website.

What Is Form W-4 Used For?

Companies require the information in the W-4 form to adjust the amount of tax they deduct from the employee’s paycheck. According to the U.S. tax system, married employees with dependents typically pay lower taxes than single individuals.

Your company’s human resources (HR) or payroll department collects these forms to determine how much tax to withhold from the employee’s wages. IRS’s online tax withholding estimator can help identify how much tax to withhold from employees. You don’t need to file it with a tax agency as it’s only held for the company’s internal processes.

State Requirements for W-4

While the W-4 form is used to determine federal tax withholding, some states require employees to fill out a separate form for state taxes. Federal W-4 and State W-4 are similar in structure, but different forms are used to distinguish the amount withheld for state taxes and federal taxes.

States that require separate W-4 forms include the following:

- Alabama

- Arizona

- Arkansas

- California

- Colorado*

- Connecticut

- D.C.

- Delaware*

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- New Jersey

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

- Vermont

- Virginia

- West Virginia

- Wisconsin

*For companies registered in Colorado and Delaware, employees can fill out the state form or use the federal one for state tax withholding.

New Mexico, North Dakota, and Utah only use the information provided on the federal W-4 form.

Alaska, Florida, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Wyoming, and Washington do not require a state form as they don’t have a state income tax.

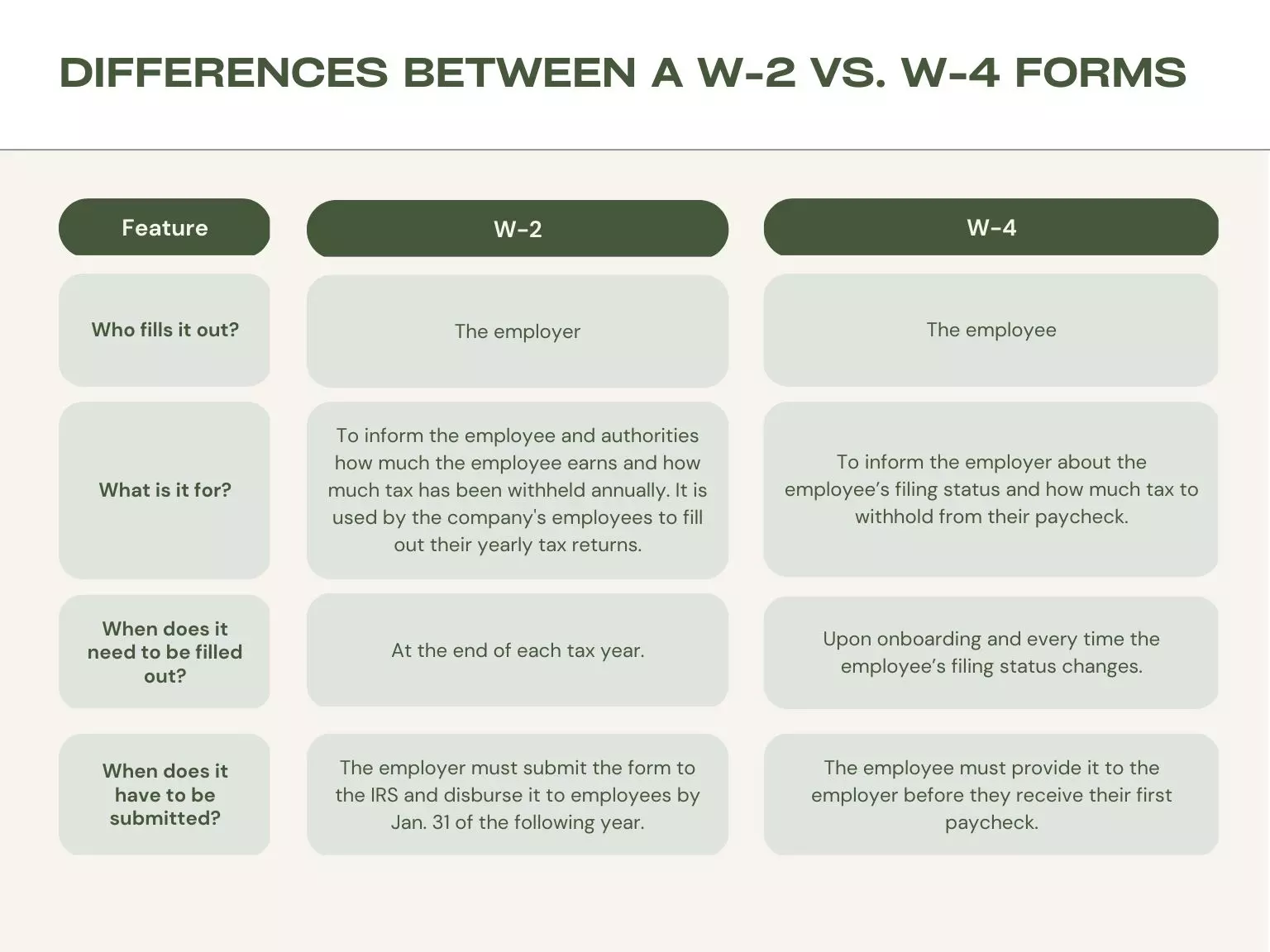

W-2 vs W-4: Major Differences

The table below outlines the prominent differences between a W-2 vs. W-4 forms:

W-2 and W-4 Forms: Tips for Small Business

Here are a few tips for small businesses to fill out W-2 and W-4 forms correctly and efficiently:

- File the W-2 form electronically and encourage your employees to also fill out their W-4 form online. The IRS suggests you do it electronically as it takes less time and saves paper. Also, storing them electronically in your company database will help you stay organized. Both forms are available for download on the IRS website: W-2 / W-4.

- Use an HR or payroll system that allows employees to fill out their W-4s electronically in a seamless way. OnPlay, Patriot, and Block are among the most popular payroll software for small businesses. These systems can also automatically calculate and deduct state and federal taxes.

- Don’t wait until the last minute to fill out W-2s. Submission after the deadline can result in a late penalty from the IRS. It would also save time to have your employees fill in their W-4 on their first day of onboarding and input that information in your payroll system as soon as possible.

- While you can’t tell your employees what to write in their W-4 form, you can assist them by providing guides from the official IRS website or the instruction pages included with the form.

- Be extremely cautious when completing W-2s for employees. Any errors or omissions can result in financial penalties for your business and employees, especially during a company audit.

- If you have any doubts about these tax forms, it’s always better to consult a tax advisor that has experience with the relevant tax forms and can answer your questions.

Tax Forms Guide for Independent Contractors

The W-2 form must be completed for employees but not for independent contractors. Employers should use the 1099-NEC (Nonemployee Compensation) form instead to report taxes for contractors. This typically refers to graphic designers, web developers, consultants, and freelance writers.

For all independent contractors that earned at least $600 during the tax year, the company should file the 1099-NEC form if they meet the following criteria:

- They are not an employee

- They are an individual, partnership, estate, or corporation

- They were paid for services in the course of your business

The 1099-NEC form is similar to the W-2 as it also reflects what you paid the contractor and how much tax you withheld from their check. Like a W-2, companies should submit the 1099-NEC form to the relevant tax authorities by Jan. 31 of the following year. The form is available for free from the IRS website.

The information to be mentioned in the 1099-NEC form includes the following:

- The company’s information: name, address, and taxpayer identification number (TIN)

- The contractor’s information: name, address, and TIN

- The total amount of compensation paid to the contractor

- The total amount of federal and state income tax withheld

Final Thoughts

W-2 and W-4 forms are essential documents that must be completed by all employers and employees, respectively. They are used to identify and report how much tax should be withheld from employees’ paychecks. It’s the employer’s responsibility to know how to file the W-2 form correctly and on time, and the employee’s responsibility to complete the W-4 Form upon being hired.

W-2 vs W-4 FAQ

If any questions remain unanswered, please refer to the responses below for some of the most commonly asked questions.

How Can I Get an Old W-2?

If an employee is wondering how to get a W-2 from a previous employer, they need to contact their employer directly. Employers are required to mail copies of W-2 forms to their employees every year. However, if the employee cannot reach their employer, they can call the IRS at (800) 829-1040 and provide their personal information, including their EIN and SSN. The IRS will then send the former employer a reminder letter to mail the W-2 form to the employee.

How Do I Fill Out a W-4 if I’m Married and We Both Work?

If the employee is married and filing jointly with their spouse, they must provide their spouse’s name and personal information and check the box “married filing jointly” in section two. Then, they should calculate the amount of tax to be withheld using the IRS tax calculator.

When Should I Fill Out and Submit the W-2 and W-4 Forms?

The employer has to fill out and submit the W-2 every year before Jan. 31. They should do this for every single employee that has earned at least $600 in the given tax year, even if they are not working at the company anymore. On the other hand, the employee must fill out the W-4 form upon onboarding and resubmit it any time their filing status changes.

How Can I Get My W-2 or W-4 Online for Free?

The W-2 and W-4 forms are available for free download on the IRS’s official website.

Table of Contents

- What Is a W-2 Form?

- What’s In a W-2?

- Who Fills Out a W-2 Form?

- How to Get a W-2 Online?

- What Is a W-4 Form?

- What’s In a W-4?

- How to Fill Out a W-4?

- Example of W-4 Form Filled Out

- How To Get a W-4 Online?

- What Is Form W-4 Used For?

- State Requirements for W-4

- W-2 vs W-4: Major Differences

- W-2 and W-4 Forms: Tips for Small Business

- Tax Forms Guide for Independent Contractors

- Final Thoughts

- W-2 vs W-4 FAQ

- How Can I Get an Old W-2?

- How Do I Fill Out a W-4 if I’m Married and We Both Work?

- When Should I Fill Out and Submit the W-2 and W-4 Forms?

- How Can I Get My W-2 or W-4 Online for Free?